The Atlantic JUN 18 2009

I have a couple of questions about the current debate. Do you think large fiscal stimulus should be controversial? And would you like to see more of it? Would you like to see a second or third stimulus, depending on where you start counting?

Well, in the first place, the E. Carey Brown analysis stressed that one shot spending gives you only one-shot response. It’s gotta be sustained. The way we got out of the 1929 Great Depression in the US — and this happened not only in the US but also in Germany and each place in which there was almost a third unemployed — was heavy deficit spending. It was not clever Federal Reserve policy, because early on the Federal Reserve had shot its bolt when we came near to liquidity trap.

I’ll speak from some experiences. My father in law was president of a national bank in Vernon, Wisconsin, population 4,100 as of the last Census. His was the only bank in the first week after Roosevelt’s bank holiday that was allowed to reopen. Why? Well, he knew every borrower and he knew better than they did what they could afford and what they couldn’t afford. And so he came into the situation with a clean balance sheet.

You think ‘Great, because we preserve the monetary supply in the system, right?’ Not great. Because the average person did not go out spending and lending freely. He bought treasury bills for as little as half a percent per annum. So the system was frozen without these supplementary expenditures, where the WPA competed with the PWA and with the reconstruction finance corporation. For really depressed situations, unorthodox central banking is needed.

We’re almost getting there. In one of Greg Mankiw’s articles, he said that maybe when the interest rate gets down to zero and it’s threatening to be negative, you should give a subsidy with it. Well, that’s what fiscal policy is!

By the way, I don’t want you to think that I think that everything for the next 15 years will be cozy. I think it’s almost inevitable that, with a billion people in China wide awake for the first time, and a billion people in India, there’s going to be some kind of a terrible run against the dollar. And I doubt it can stay orderly, because all of our own hedge funds will be right in the vanguard of the operation. And it will be hard to imagine that that wouldn’t create different kind of meltdown.

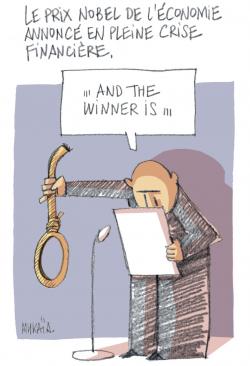

Last thing. Mea culpa, mea culpa. MIT and Wharton and University of Chicago created the financial engineering instruments, which, like Samson and Delilah, blinded every CEO — they didn’t realize the kind of leverage they were doing and they didn’t understand when they were really creating a real profit or a fictitious one. There ‘s a lot of causality in economics, even though it’s very far from an exact science.

A question about the exact science stuff before going back to policy questions. One of the things for which you are most famous is for writing the Foundations of Economic Analysis, which as I understand it attempted to bring a kind of mathematical uniformity to the field —

Well, I would say a mathematical searchlight —

Okay, what’s the distinction there? I’m curious what you think about some recent developments in economics, some of the movements that are hot right now — like behavioral economics, part of which wants to challenge the notion of humans as utility maximizing rational agents.

In my view behavioral science describes an extremely large and important part of the modern picture. However, whenever the economy turns in a very irrational way, that can create opportunities for very rational speculators to make a profit. So you can still get some approximation on the micro level of an efficient market. But there never has been a true macro efficient market. You just have to look at the record of economic history the ups and downs. Bubbles are self-generating.

And I’m not sure most of the people that get caught up in the middle of a bubble can be described as irrational. It seems pretty rational to buy a house and flip it in the next few weeks at a profit when that’s been happening for along time. It works both ways.

The crowd mentality is maybe not rational.

Well, let’s put that differently. It’s not optimal. It’s what it is. You have to cope with people. Now, if all the people had gone to the Wharton School and become very sophisticated that doesn’t mean the society in which they lived and operated would be incapable of having a business cycle or bubbles. They’re self generating.

So are people utility maximizing and rational and can we make sense of interpersonal comparisons of utility in a mathematical way?

No. But you know, people say, ‘greed has suddenly increased.’ But it isn’t that greed’s increased. What’s increased is the realization that you’ve got a free field to reach out for what you’d like to do. Everybody would still like to retire with a satisfactory nest egg in real terms. And the tragedy of this unnecessary eight-year interlude is that much of what has been accumulated is gone and gone forever. And no amount of pumping is going to bring back into reality what were ill-advised overextensions of bridges to nowhere and housing developments for which there was no effective demand.

With the Foundations, I looked around for the best bicycle in town. It wasn’t perfect, but it was better than what had been assigned previously.

Back to some middle-term and long-term policy questions. Even if it makes sense to think about deficit-financed government demand stepping in and replacing a drop off in household demand, do you worry about the rising deficit and the potential risk of inflation? There’s been a lot of articles on this in the past two weeks — Paul Krugman and Niall Ferguson and others.

I think it would be surprising if, down the road — not in the long long run but in the somewhat short run — we don’t have some return of inflation. On the other hand, I’m of the view that if we come out of this with some kind of temporary stabilization at least, and the price level is let’s say 10-12% above what it was before we got into the meltdown, I think that’s a price I would be willing to pay!

Unfortunately, after World War One — in 1925 when the British tried to put the pound back to the 1914 level against Keynes advice — it turned out that Keynes was very right and a lot of the subsequent grief in the British empire traces to that wrong decision. I’m against inflation, but what I worry about is continuing, galloping, self-reinforcing inflation. I would not try to roll things back to some sacred earlier price level.

And China .. You’ve written some about that. How real do you think the threat of a run on the dollar is? Some people, like your nephew Larry Summers has said that there’s kind of “balance of financial terror” there — that it’s not in China’s interest to see a big decline in the value of dollar denominated assets.

Well first let me say that I have big admiration for Larry Summers as an economist. However, when he was at MIT as an undergraduate, he never took a course of mine!

But I think he was wise. If he had people could always say, ‘well, he’s traveling on someone else’s steam.’ There’s a Chinese wall between him and me. Any view he expresses and any view I express — there might be some overlap, but there’s nothing synchronized.

So you’re not in touch with him now?

No.

Certainly, some of the reasons the Chinese have stuck with huge amounts of reserves in very low interest rate US assets has been to keep the export led program that they espouse in existence. They can still succeed there by taking the reserves out of prime zero-interest stuff and putting it in our general stock market and so forth, the way Dubai and some of the other countries are beginning to do. So I think we’ve got — in the long term — a lull in our favor, but it’s a lull in our favor that, rationally, is probably not going to persist.

I just have two more questions. First, when I told people that I was going to talk to you this morning, the question that came up most had nothing to do with economics and was usually some variation of “how are you still doing stuff at 94?” What’s the secret?

Well, I’ll tell you! Luck. My female genealogy is very favorable. My aunts and so forth all lived into their 90s. My male genealogy was deplorable. And for the first 35 years of my life there was no treatment for hypertension. So part of my brashness was probably, “If I’m going to do something I better do it early.” But my very good internist at MIT said ‘hey, we can do something about that now.’ And luckily I picked someone at the very good lab at Boston University Medical where some of the original anti-hypertensives and anti cholesterol medication and so forth was developed. So I’m a tribute to the advance of modern medicine.

However, I’ll take a little credit for helping it along. I switched to skim milk when everyone said it was crazy. And I was always pretty well off. You know what happiness is: ‘Having a little more money than your colleagues.’ And that’s not so tough in academic life.

Very last thing. What would you say to someone starting graduate study in economics? Where do you think the big developments in modern macro are going to be, or in the micro foundations of modern macro? Where does it go from here and how does the current crisis change it?

Well, I’d say, and this is probably a change from what I would have said when I was younger: Have a very healthy respect for the study of economic history, because that’s the raw material out of which any of your conjectures or testings will come. And I think the recent period has illustrated that. The governor of the Bank of England seems to have forgotten or not known that there was no bank insurance in England, so when Northern Rock got a run, he was surprised. Well, he shouldn’t have been.

But history doesn’t tell its own story. You’ve got to bring to it all the statistical testings that are possible. And we have a lot more information now than we used to.

Are you happy with the way economics is being taught now? You’ve mentioned Greg Mankiw’s textbooks.

Well to say that I’ve read them would be an exaggeration. I looked into them, and I was disappointed that they were so bland. [Laughs] No, he’s a gifted writer. But an economist with a facile pen isn’t necessarily an overnight expert on the likelihoods in our inexact science.